Discover how Ordnance Survey data is driving more efficient decisions in organisations like yours.

Case Studies

- Page 1

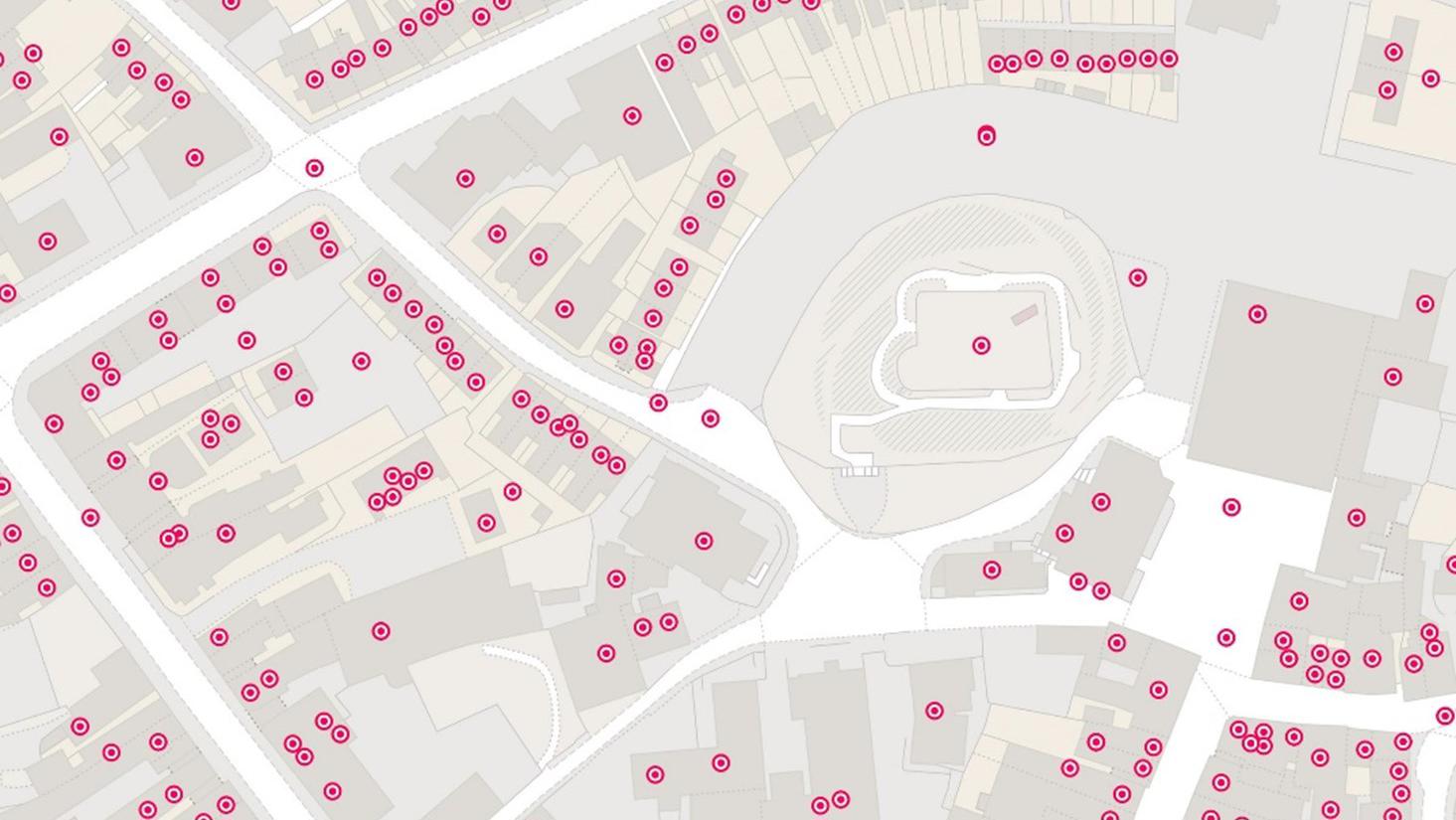

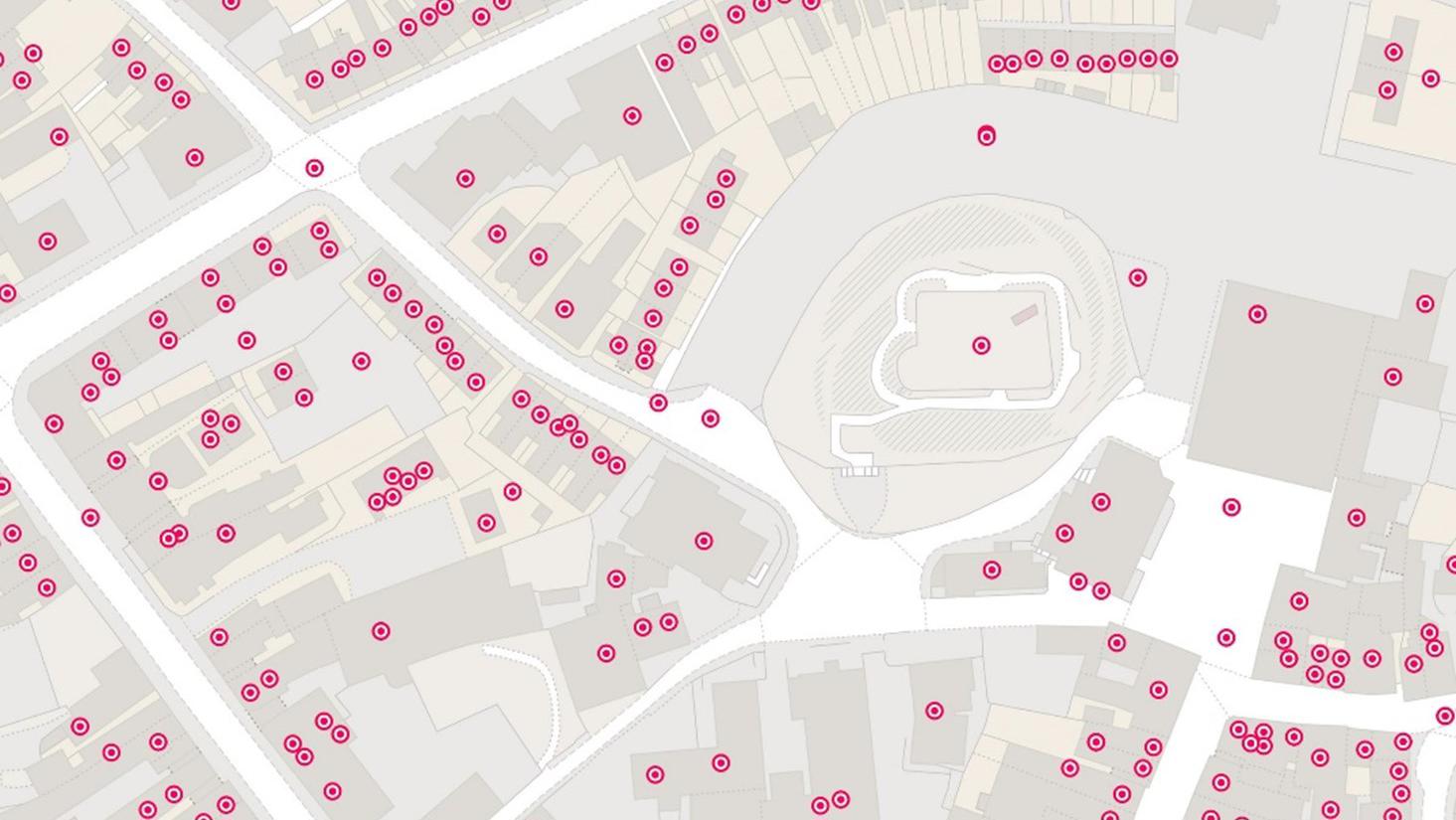

Dubai Municipality has a clear ambition to make Dubai the happiest city in the world in all aspects. As one of the fastest growing cities in the world, it is constantly evolving to accommodate new areas for retail, business, and services every day. This rapid and purposeful development is contrib...

The Metropolitan Police is the UK’s largest police force. It polices 620 square miles and serves more than eight million people across one of the world’s most dynamic and diverse cities.

Part of its mission is to seize the opportunities of data and digital technology. To help a...

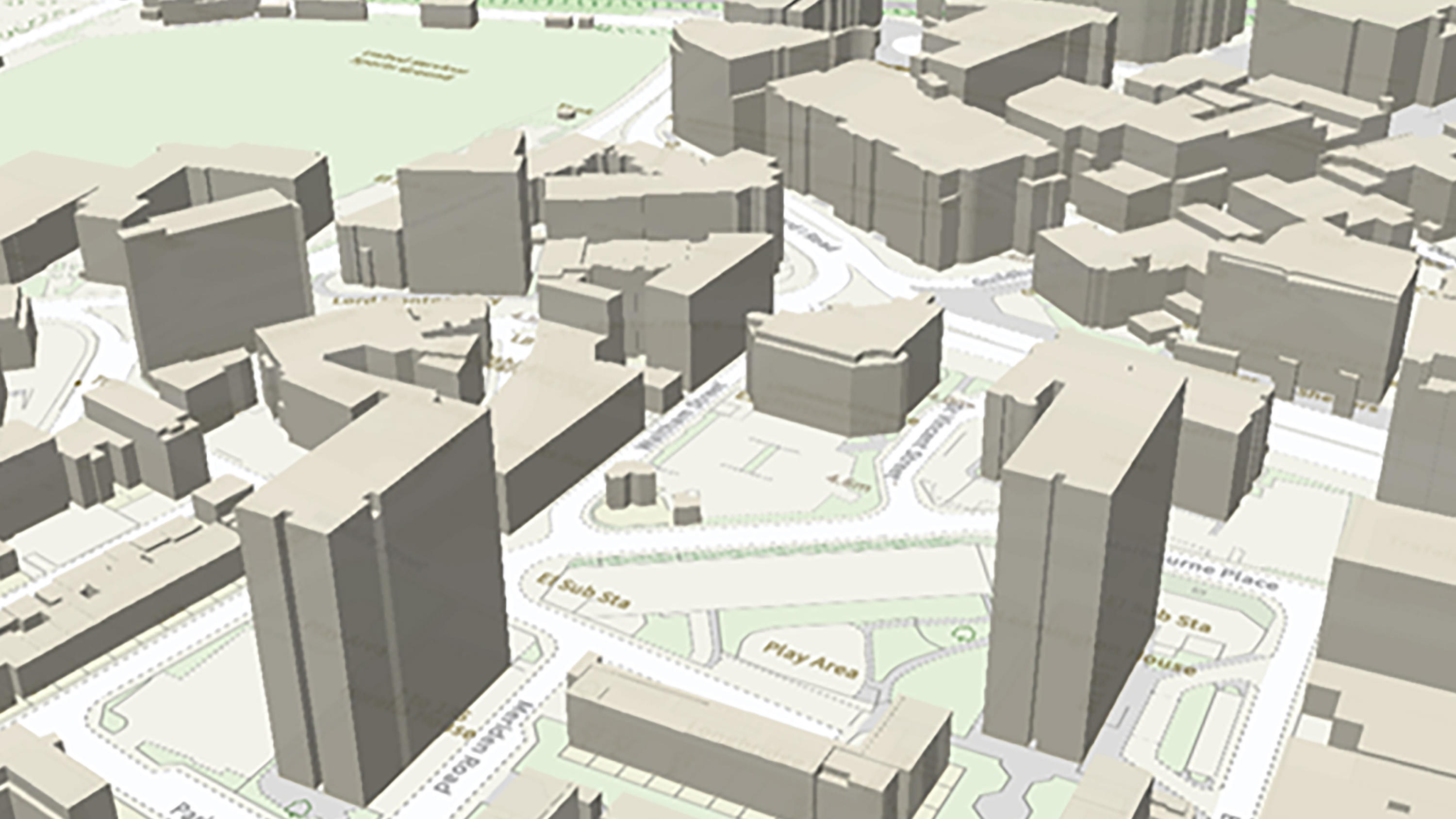

The British Army is using Ordnance Survey mapping data to create training scenarios, and provide soldiers with accurate and realistic experiences.

McQueens Dairies is a third-generation family firm that provide doorstep milk delivery. Established in 1995, they started with a single milk round in St Andrews, Scotland. Fast forward 28 years and they deliver to thousands of households throughout the UK.

Increasing efficiency in business...

Ordnance Survey helped to enable a master source of address information to be collated into a central hub that Scottish Water, their partners, and agencies, can use to seamlessly manage the lifecycle of an address.

Discover how Cleveland Police deals with geographic issues and understands its communities better, by using Ordnance Survey location data to meet challenges and respond to emerging issues.

The importance of access to green outdoor spaces in relation to health and wellbeing is clear. However, deprived areas are less likely to have access to green space and gardens.

In 2021 the Government allocated £9 million of funding to a ‘Levelling Up Parks Fund’ to help...

The first duty of the government is to keep citizens safe and the country secure.

Working with 29 separate agencies and public bodies including the Police Advisory Board for England and Wales, the Security Service, the Advisory Council on the Misuse of Drugs, Gangmasters and Labour Abuse A...

Following the tragic Grenfell Tower disaster, the Government led a programme of work delivered by Fire and Rescue Services across the country; to make high-rise residential buildings safer, and provide a better understanding of high-rise residential buildings.