Challenge

As a challenger bank, CCB faces smaller markets and greater competition. It also has a strong commitment to responsible lending, as well as Environmental, Social and Governance (ESG). As such, to better manage its portfolio and understand the locations of properties it supports, CCB requires accurate address data for mapping, capturing, and analysing climate risk data.

ESG is a broad and growing area referring to a wide number of considerations, criteria, and risks. It includes how companies may score on responsibility metrics, and how investors will consider behaviours and policies.

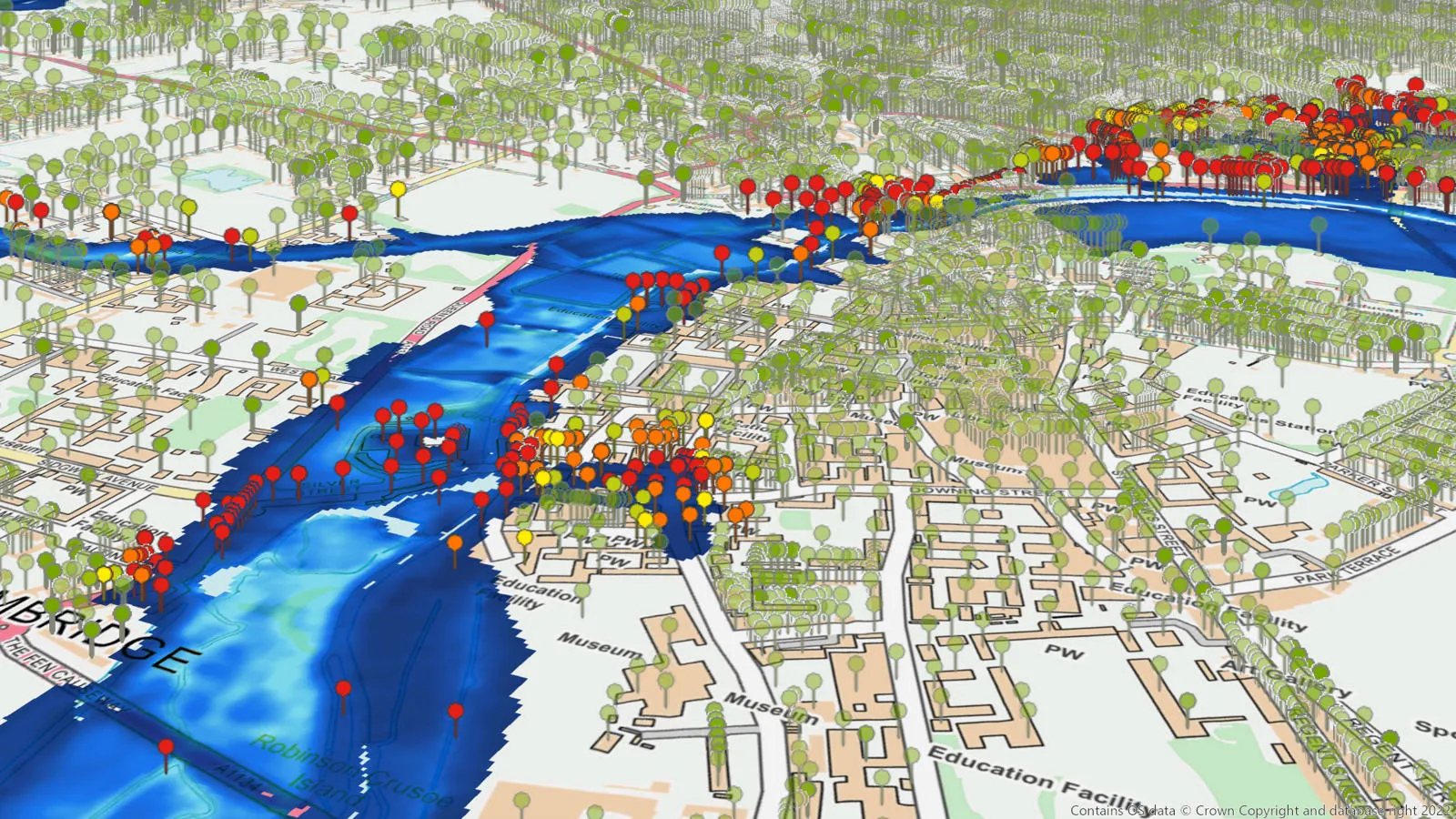

Climate risk data typically informs two key objectives: identifying physical risks, such as flooding potential; and transition risks, taking into consideration customers’ CO2 emissions that may impact a bank during the wider movement towards a lower carbon economy.

Therefore, CCB needed to better understand its portfolio of customers. It needed up-to-date records of flooding information for risk assessment; and it needed ESG compliance to meet growing regulatory expectations.

Almost three years ago, CCB realised that there was limited data related to flooding and associated risks. At the time, CCB had a small team facing labour-intensive challenges to make their data and accuracy better for scenario modelling. CCB faces high expectations for Net Zero targets and has made its own lending commitments spanning 25–30 years. Its teams require informed scenario modelling for the long term. Climate-based effects, such as flooding, may increase in those 25 years, and CCB needs to understand the impact. However, CCB used the Environment Agency datasets, which only contained information on England and Wales.

Also, CCB faced additional challenges in data quality – an ongoing challenge in the finance sector. Two-thirds of CCB’s portfolio were commercial premises that can have complex addresses.

Overall, CCB required more data for risk assessment, and it needed support in improving data quality once they had it. Resolving the data matching challenge would improve data quality and enable more insightful scenario modelling of the portfolio.

Given that this proved to be a very labour-intensive manual exercise with limited resources, CCB sourced it from external agencies.

Solution

To resolve its dataset requirements, CCB found a third-party agency and supportive partner, Twinn by Royal Haskoning DHV (formerly Ambiental), which provided climate-risk data through its Climate Risk Score product.

Twinn provides physical climate risk assessments and global climate data and analytics for multiple industries, along with a range of other decision intelligence solutions. For CCB, Twinn Climate Risk Score contained more extensive climate-risk data, up to 19 different hazards and counting, including flood risk which could impact its portfolio. Twinn also provided a six-monthly refresh of its flood data. This enabled better modelling exercises, such as: ‘If 5% of our portfolio moves to the highest flood zone within 20 years, how does that impact us and our customers?’

The Twinn-based data still needed to be matched to CCB’s portfolio, so they decided to use OS addressing data to match datasets and improve reliability. CCB chose to use OS and the Unique Property Reference Number (UPRN) to help resolve the address matching issue.

Result

"We were able to improve address mapping through OS and UPRNs to improve our data quality. The UPRN is facilitating and enhancing data matching capability; we have the exact point of a property."

Twinn provided access to OS AddressCore under a license agreement. The match rate was stronger using the OS AddressBase Core data; especially for residential properties.

AddressBase Core data contains a full, national-scale address database containing all address records for Great Britain (circa 33 million) along with the UPRN and XY coordinates for all address records—a complete database to match any address. As there are quite a few changes to AddressBase in each release (known as Epochs by OS) to include new addresses or update changes to addresses, for example, where a property number is changed to a name, we generally see most of the market requiring these updates to enable the highest match rate on all addresses.

Benefits

“90% of our customers are professional landlords; they have high expectations of their lenders, and sustainability is becoming more relevant,” says Andy Tovey. “We feel more confident in supporting new and existing businesses when we are starting from an informed position. It’s not about raising rates; it’s about assessing and managing the potential climate risk. Being more informed means we’re able to educate our customer base and the sector by using location data to our advantage.”

Bigger organisations in the financial sector typically have dedicated teams and in-house expertise to take advantage of location data and insight. CCB can still achieve the same outcomes through strong relationships with third-party agencies and partnerships. Combining insight from Twinn with address matching from OS, CCB now has better data quality when mapping climate risk data.

"Twinn is dedicated to helping lenders like Cambridge & Counties Bank understand and mitigate the risks associated with climate change. By leveraging our partnership with Ordnance Survey, we deliver comprehensive data and analysis that empower responsible lending decisions."

The UPRN, the ‘golden thread’ identifier, enables disparate (often siloed) datasets, such as flood, energy performance certificates (EPC), CO2 emissions, etc., to be linked together. CCB can use UPRNs to connect relevant data to a single property.

This is a growing requirement within the financial sector. ‘Financed emissions’ are defined as Scope 3 indirect emissions attributed to finance, which includes lending and investments. CCB’s regulators and other key stakeholders expect financed emissions to be disclosed as part of commitments towards Net Zero by 2050.

Improving its data matching has also helped mitigate CCB’s reporting requirements, and it will be able to demonstrate progress to its key stakeholders. CCB’s regulators want to see data improvements, year on year, so CCB needed a system and support in place to enable continuous improvement. Twinn proved a valuable collaborative partner in its optimisation; CCB praised Twinn for “its reliability to deliver when we need the information.”

OS Licensed Partners

Royal Haskoning DHV is a Licensed Channel Partner and a member of the OS Partner ecosystem. OS Partners are market experts that use OS location data to create innovative products and services — new solutions to solve problems. OS provides the data, like building blocks, and Partners build with them. This expands the reach of OS and its customer base, adding new sector expertise and market knowledge.

CCB considered itself inexperienced in geospatial data and accessed the OS Partner Network to find supportive agencies that could help.

To learn more, you can find an OS Partner that would help your organisation with its solutions and challenges; if your organisation is interested in collaborating, you could become an OS Partner.

"As a responsible financial services institution, we are committed to playing a significant role in the drive towards greater sustainability in the UK banking sector. In line with this commitment, we are continuously refining our climate risk data to enhance our knowledge and understanding of our customers' property portfolios. The services provided by our valued third-party consultants, Twinn, and Ordnance Survey, play a pivotal role in supporting this process. By leveraging their expertise and insights, we aim to strengthen our risk management practices and better serve our customers and the environment."