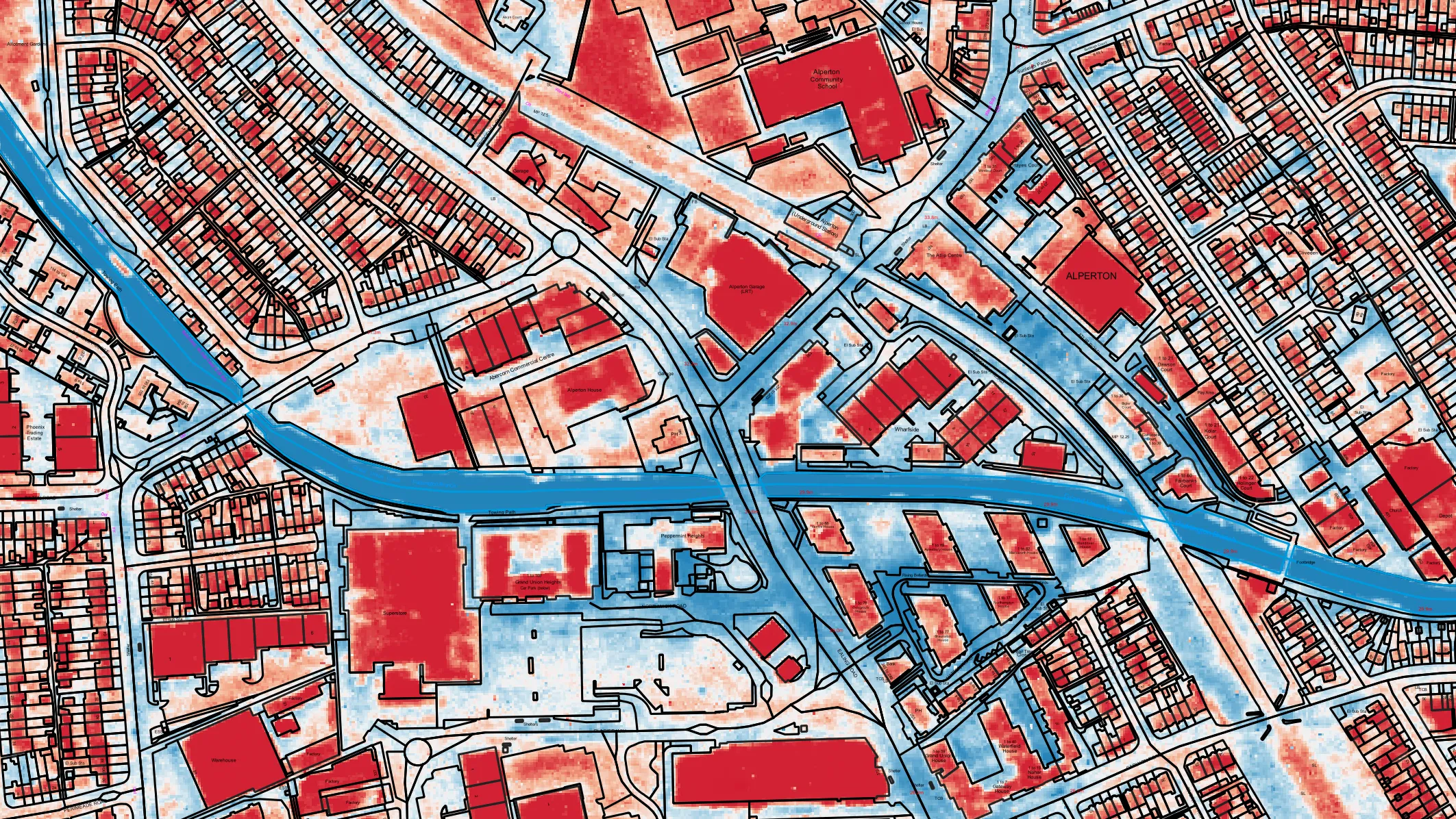

The best decisions in banking and insurance depend on having the best data. With Ordnance Survey (OS) you can enrich every decision by unlocking location data that’s unparallelled in depth and accuracy. So, whether you’re assessing individual mortgages and home insurance policies, or conducting risk assessments for large commercial sites, eliminate doubt and get the insights you need to adapt in a fast-changing landscape.

With OS data products embedded into your systems, get accurate data that goes beyond the address to the complex geographic factors that bring greater clarity – and enable you to offer more personalised services, too.

Know where the risks are. Know that customers are who they say they are. And make locations uniquely identifiable.